AI in Finance: Enhancing Efficiency and Customer Satisfaction

Written By:

Last Updated Date:

TL;DR

AI transforms finance by enhancing customer service, optimizing risk management, and automating tasks. Predictive analytics and machine learning boost efficiency, reduce errors, and offer deep insights into customer behavior. Widely adopted in banking, investment, insurance, and fintech, AI tools like chatbots and fraud detection systems improve customer satisfaction and operational efficiency. AI-driven trading and personalized services revolutionize operations and customer interactions.

AI provides actionable insights from large datasets, aiding decision-making and product development. It automates routine tasks, ensures regulatory compliance, reduces costs, and increases productivity. Leveraging AI allows financial institutions to meet evolving demands, drive growth, and foster innovation, making finance more efficient, secure, and customer-centric.

Key Takeaways

- Supercharged Efficiency and Accuracy: AI boosts efficiency and accuracy across financial operations by automating routine tasks and reducing errors. Imagine a world where AI handles mundane tasks seamlessly, freeing up human talent for strategic decision-making and innovation.

- Personalized Customer Experiences: AI transforms customer service by providing 24/7 support through intelligent chatbots and tailored financial advice. Imagine having a financial assistant who knows your needs and preferences, offers bespoke solutions, and enhances your satisfaction and loyalty.

- Proactive Risk Management: AI revolutionizes risk management with advanced fraud detection and predictive analytics, identifying threats before they become problems. Envision a system that keeps your finances secure and anticipates and mitigates risks, ensuring a robust and resilient financial landscape.

How AI in Finance is Revolutionizing Fraud Detection?

Imagine Emma, a dynamic CFO at a mid-sized financial firm, always looking for innovative solutions to elevate her company. Despite her firm’s success, they faced a daunting challenge: outdated fraud detection systems that couldn’t keep pace with cybercriminal’s increasingly sophisticated tactics. The losses from fraud were mounting, and client trust in financial institutions was eroding.

Determined to turn the tide, Emma explored various solutions and decided to implement an AI-powered fraud detection system. The transformation was nothing short of revolutionary. The new AI system could analyze real-time transaction data, accurately identifying suspicious activities. Fraud attempts plummeted, and client trust was restored. The firm survived and thrived, showcasing AI’s transformative power in finance.

The Impact of AI in Finance on Customer Experience

Artificial Intelligence (AI) and deep learning are revolutionizing the financial services industry, bringing unprecedented efficiency and accuracy. Machine learning algorithms are now integral for processing large volumes of data, identifying patterns, and making highly accurate predictions.

These advancements are crucial for tasks such as fraud detection and financial forecasting. By automating these processes, financial institutions can more effectively prevent financial crimes and optimize their investment strategies, ultimately enhancing their decision-making capabilities.

The Power of AI in Finance Automation

The financial industry also sees cost reductions and improved operational efficiency thanks to AI-driven automation. Robotic process automation (RPA) is streamlining back-office processes such as data entry, compliance checks, and transaction processing. This speeds up these tasks and reduces human errors and operational costs.

By automating routine activities, financial institutions can focus their human resources on more strategic and value-added activities, driving further innovation and transformation in the sector.

AI’s Transformative Impact on Finance

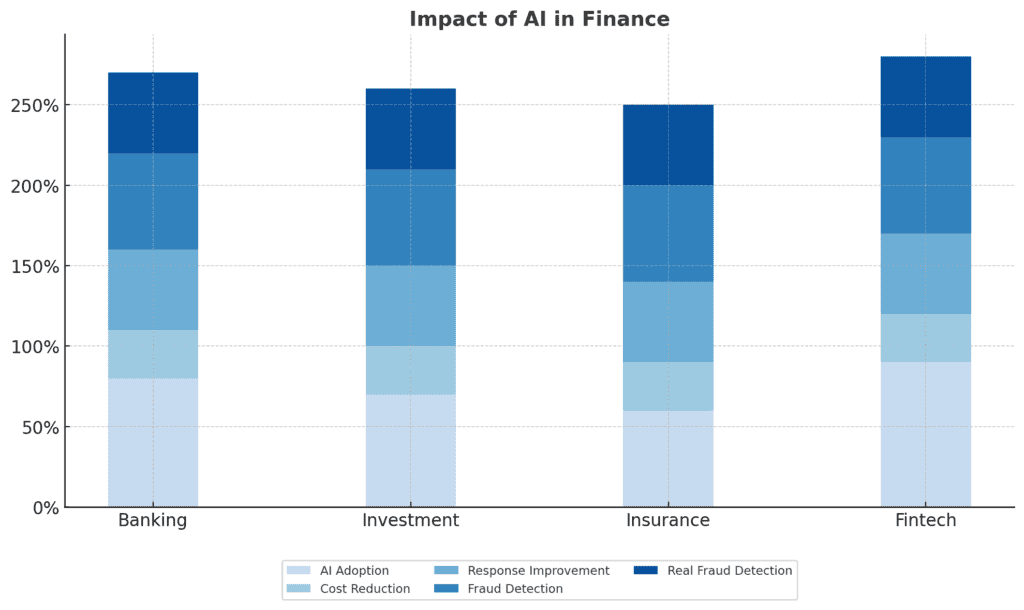

The chart illustrates the percentage contributions of various AI-driven improvements across the Banking, Investment, Insurance, and Fintech sectors. Each bar is segmented to represent specific impact areas, including AI Adoption, Cost Reduction, Response Improvement, Fraud Detection, and Real Fraud Detection, providing a clear visual of how AI enhances these key financial domains.

AI in Finance: The Impact of AI

The AI Revolution in Finance

In today’s fast-paced digital world, the finance industry is experiencing a transformation unlike any other. The driving force behind this revolution? Artificial Intelligence (AI). From enhancing customer service to optimizing risk management, AI’s applications in finance are vast and varied.

Enhancing Efficiency and Decision-Making with AI

AI technologies, like predictive analytics and pattern recognition, enhance efficiency in investment management and decision-making processes. When we automate tasks and analyze data at scale, Artificial intelligence streamlines operations and reduces manual errors, which improves overall productivity in financial services organizations.

The Dawn of AI in Finance

How AI and Big Data are Revolutionizing the Finance World

Artificial Intelligence and Big Data are transforming the finance world in remarkable ways. Imagine banks and financial institutions being able to process massive amounts of data quickly, spot fraud before it happens, and manage risks more effectively. This technology saves time and money while reducing errors, making financial operations smoother and more reliable.

Enhancing Customer Service with AI in Finance

Customer service is also getting a significant boost from AI. Picture chatbots and virtual assistants ready to answer your questions, offer financial advice, and assist with transactions around the clock. These intelligent tools use your data to provide personalized service, making your experience more enjoyable and building loyalty.

Transforming Investment and Trading with AI and Big Data Analytics

In the world of investment and trading, AI is making a huge difference, too. It helps traders make faster and more precise decisions by analyzing market data in real-time. This reduces mistakes and biases, making trading more efficient. As AI continues to improve, it will open up new opportunities for growth and innovation, creating a more dynamic and responsive financial landscape.

Enhancing Customer Service

Revolutionizing Customer Service

AI is revolutionizing customer service in the finance industry, making interactions faster and more personalized. Imagine having a virtual assistant ready to answer your banking questions any time of the day or night. That’s what AI-driven chatbots do.

They provide 24/7 service, quickly responding to millions of customer queries at a low cost. These chatbots are becoming a standard in the industry, especially popular with younger customers who prefer chatting with AI over making phone calls.

Personalized Financial Advice with AI in Finance Professionals

Beyond just answering questions, AI takes customer service to the next level by offering personalized financial advice. Analyzing your data allows AI systems to provide recommendations tailored to your specific needs. This helps banks understand and predict what you might need, allowing them to solve issues before they become problems.

This proactive approach improves efficiency and helps build stronger, more personal customer relationships, ensuring a better overall experience.

Revolutionizing Risk Management

Revolutionizing Risk Management

AI is revolutionizing risk management in the financial sector by enhancing the ability to detect and prevent fraud, money laundering, and other risks. AI systems analyze large volumes of data in real time, identifying patterns and anomalies that indicate potential threats.

For example, AI can monitor transactions to flag suspicious activities and alert authorities immediately. This proactive approach improves risk detection accuracy and significantly reduces the time and resources needed compared to traditional methods.

Predictive Capabilities of AI in Finance Risk Management

AI’s predictive capabilities are transforming how financial institutions manage risks. Using machine learning algorithms, AI can predict future risks based on historical data and current trends. This allows institutions to take preventive measures before risks escalate.

AI’s Impact on Loan Risk Assessment and Creditworthiness

For instance, AI can help assess loan risks and borrowers’ creditworthiness by analyzing more variables than traditional methods, leading to more accurate and unbiased credit decisions. As AI technology advances, its role in risk management will become even more critical, offering more robust and comprehensive solutions to mitigate financial risks effectively.

Fraud Detection and Prevention

Enhancing Financial Security

AI’s role in fraud detection and prevention cannot be overstated. AI systems can accurately detect fraudulent activities by analyzing transaction patterns and identifying anomalies. This not only helps in preventing fraud but also enhances the overall security of financial transactions. Machine learning algorithms are particularly effective, as they continuously learn from new data to improve their detection capabilities.

Revolutionizing Fraud Detection with AI

Fraud detection and prevention are crucial in finance, and AI is making these processes more effective. Traditional methods often can’t keep up with fraudster’s sophisticated tactics.

However, with its advanced machine learning algorithms, AI can analyze vast amounts of data in real time to spot patterns and anomalies that signal fraudulent activities.

For instance, AI systems can detect unusual transaction patterns, verify user identities, and flag suspicious activities, helping banks and financial institutions stop fraud before it happens.

Enhancing Cybersecurity with AI in Finance Professionals

AI is also boosting cybersecurity in the finance world. With more digital transactions, the risk of cyber-attacks has increased. AI-driven cybersecurity systems can proactively monitor and protect networks, identifying and responding to threats much faster than traditional methods.

These systems analyze data from various sources to spot potential vulnerabilities and take preventive measures to secure financial data. This protects financial institutions and builds consumer confidence in digital financial services.

AI is a Powerful Tool Against Financial Crime

AI’s ability to process and analyze large datasets in real time makes it a powerful tool in the fight against fraud, cyber threats, and financial crime. It ensures that financial institutions can stay ahead of criminals and keep their customer’s data safe.

Algorithmic Trading

AI in Algorithmic Trading

Algorithmic trading is another exciting application of AI in finance. AI algorithms analyze vast market data to predict stock movements and execute trades at optimal times. This enhances trading efficiency and profitability, giving financial institutions a competitive edge. Companies like Kavout use AI to provide actionable insights on stock prices, helping traders make informed decisions.

Transforming Financial Markets with AI-driven Algorithmic Trading

Algorithmic trading has transformed financial markets using advanced AI systems to make rapid trading decisions. These systems analyze massive amounts of data and execute trades at speeds humans can’t match.

Known as high-frequency trading, this approach allows millions of trades daily, taking advantage of opportunities to buy or sell based on set criteria like stock prices and market conditions.

By automating trading, AI minimizes human error and emotion-driven decisions, ensuring trades happen at the best times, boosting market efficiency, and cutting costs.

Enhancing Market Transparency and Liquidity

AI in algorithmic trading also improves market transparency and liquidity. These algorithms can quickly interpret market signals from various sources, such as news, social media, and historical data, allowing them to adapt to market changes in real-time. This leads to more precise trading strategies that respond instantly to market shifts.

As a result, AI narrows the gap between buy and sell prices, reduces the chances of bad trades, and provides more accurate pricing information, enhancing the overall quality of the market.

Opening New Investment Opportunities with AI

AI-driven algorithmic trading opens up new investment opportunities and strategies. Tools like robo-advisors and intelligent beta strategies use AI to provide personalized financial advice and manage investment portfolios based on individual preferences.

These advancements make sophisticated trading strategies accessible to more people, ensuring investment decisions are based on data and optimized for better returns. This makes financial markets more efficient and accessible to all types of investors.

Personalized Financial Services

Revolutionizing Personalized Financial Services with AI

AI enables financial institutions to offer personalized services by analyzing customer data and behavior. This allows for tailored financial advice and product recommendations, enhancing customer satisfaction.

For example, AI-powered tools can analyze a customer’s spending patterns and financial goals to provide personalized budgeting advice and savings strategies.

Customized Financial Advice and Solutions with AI

AI is revolutionizing personalized financial services, allowing banks to offer customized advice and solutions tailored to each customer. With advanced algorithms and predictive analytics, AI can use vast customer data to give personalized financial recommendations. Banks can meet individual needs more effectively, boosting customer satisfaction and loyalty.

AI’s Impact on Wealth Management and Investment Firms

AI is making a big difference in wealth management and investment. Robo-advisors, powered by AI, learn from customer behavior and market trends to give customized investment advice and manage portfolios.

These systems can predict financial outcomes based on current spending and investment patterns, helping customers make smarter financial decisions. This level of personalization ensures customers get relevant and timely advice, leading to better financial results and greater trust in their financial institutions.

AI in Credit Scoring and Loan Approvals

AI is also crucial in credit scoring and loan approvals. Traditional credit scoring models often miss the whole financial picture, especially for those with limited credit histories.

AI uses various data points to assess creditworthiness more accurately, making financial services available to more people. By analyzing transaction history, spending patterns, and even social behavior, AI provides a fairer credit risk assessment, helping extend financial services to a broader range of customers.

Improving Operational Efficiency

Enhancing Operational Efficiency with AI in Finance

Operational efficiency is a key area where AI shines. By automating routine tasks and processes, AI helps financial institutions reduce operational costs and improve efficiency. For instance, robotic process automation (RPA) uses software bots to handle high-volume, repetitive tasks like loan processing and claims management, thus reducing human error and speeding up operations.

Transforming Everyday Tasks with AI

AI is transforming the finance industry by making everyday tasks faster and more efficient. By automating routine work, AI reduces the need for manual effort and reduces mistakes. This speeds up transactions and ensures they are done accurately, saving money and boosting productivity. For example, AI can quickly handle many transactions and data entries, allowing employees to focus on more complex tasks requiring critical thinking and decision-making skills.

Advanced-Data Analytics for Improved Efficiency

AI also improves efficiency through advanced data analytics. It can analyze vast amounts of real time data to provide insights that help financial institutions make better decisions.

With predictive analytics, banks can foresee market trends, customer behaviors, and potential risks. This proactive approach helps with planning and strategy, leading to better resource use and overall performance.

Making Financial Operations More Resilient

As a result, AI makes financial operations more efficient, resilient, and adaptable to market changes.

Ensuring Regulatory Compliance

Enhancing Compliance with AI in Finance

Compliance with regulatory requirements is a significant challenge for financial institutions. AI helps automate compliance processes and regulatory reporting, ensuring institutions adhere to legal requirements. This reduces the burden on financial institutions and minimizes non-compliance risk.

Streamlining Compliance Processes with AI

Ensuring regulatory compliance is a big challenge for the finance industry, but AI is making it easier and more efficient. With AI technologies, especially those in RegTech, financial institutions can keep up with constantly changing regulations. AI automates compliance processes, ensuring all necessary protocols are followed and quickly adapting to new rules. This eases the workload for compliance officers and reduces the risk of human error, resulting in a more streamlined and effective compliance system.

AI-Powered Tools for Better Regulatory Oversight

AI-powered tools also improve how regulators monitor and supervise financial institutions. These tools can analyze large amounts of data in real time, spotting potential compliance issues before they become significant problems. For instance, AI can track transaction patterns and detect unusual activities that might indicate non-compliance.

This proactive approach helps maintain regulatory standards and creates a more robust and transparent financial system. Using AI, financial institutions can meet regulatory requirements more efficiently, and regulators can oversee the industry’s compliance efforts more effectively.

Data Analysis and Insights

Transforming Data Analysis and Insights with AI in Finance

AI’s ability to process and analyze large volumes of financial data provides actionable insights that aid strategic decision-making. By unstructured data and uncovering patterns and trends that would be impossible for humans to detect, AI enables financial institutions to make data-driven decisions and improve overall business intelligence.

Accelerating Data Analysis and Strategic Decision-Making

AI transforms how financial institutions handle data analysis and insights, making the process quicker and more accurate. Banks and financial organizations now use AI to sift through massive amounts of data, spotting patterns and trends that were hard to see.

This helps them make smarter decisions, refine their strategies, and offer better services. For example, by analyzing customer transaction data, AI can predict future spending habits, allowing banks to provide personalized financial products and services tailored to individual needs.

Enhancing Risk Management and Fraud Detection with AI

Additionally, AI is enhancing risk management and fraud detection. It continuously monitors data in real time, identifying unusual patterns that might indicate fraud. This proactive approach means banks can stop fraudulent activities before they happen, protecting themselves and their customers.

AI also helps ensure that all financial operations comply with the latest regulations, reducing the risk of fines and penalties.

Revolutionizing Business Intelligence in Finance

AI’s ability to turn data into actionable insights is revolutionizing the finance industry, making it more efficient and trustworthy.

Innovating Product Development

Leveraging AI for Innovative Financial Product Development

Financial institutions leverage AI to develop innovative financial products and services, staying ahead in a competitive market. By understanding customer needs and market trends, AI helps investment firms create products that meet evolving customer demands, ensuring a competitive edge.

Revolutionizing Product Development with AI

AI is revolutionizing product development in finance by creating more personalized and efficient services. By analyzing vast amounts of data, AI can identify customer’s needs and wants, allowing banks to develop tailored products that boost satisfaction and loyalty. This personalization helps financial institutions grow and stay competitive.

Accelerating Product Development Processes

Additionally, AI speeds up the product development process by automating complex tasks. It can analyze market trends and customer feedback in real time, offering insights that guide product design and strategy. This quick adaptation to market changes ensures financial institutions stay ahead in innovation.

Conclusion

AI is revolutionizing finance, bringing transformative changes that enhance efficiency, accuracy, and customer satisfaction. As Emma’s story illustrates, integrating AI can make finance professionals turn significant challenges into opportunities for growth and innovation. By embracing AI, financial institutions can not.

AI is revolutionizing finance, creating more personalized and efficient services. By analyzing vast data, AI identifies customer needs, allowing banks to develop tailored products that boost satisfaction and loyalty and ensure growth and competitiveness.

Moreover, AI accelerates product development by automating complex tasks. It analyzes market trends and customer feedback in real time, offering valuable insights that guide product design and strategy. This rapid adaptation to market changes helps financial institutions stay ahead in innovation, maintaining a competitive edge in the ever-evolving economic landscape.

Frequently Asked Questions (FAQ)

I’m a Data Enthusiast and Content Writer with a passion for helping people improve their lives through data analysis. I’m a self taught programmer and has a strong interest in artificial intelligence and natural language processing. I’m always learning and looking for new ways to use data to solve problems and improve businesses.