Small Business BI Metrics: Double your Profits

Written By:

Last Updated Date:

Today, we’ll discuss small business BI metrics. The right metrics can make the difference between thriving and merely surviving. Tracking some metrics to grow your business is essential, but what should you focus on?

Today, I will give you some metrics to track for better business outcomes. And I will help you make data-driven decisions that drive real results. So don’t miss that chance, and let’s explore the shiny world of metrics and how it can change your life if you identify what to look for exactly!

Key Takeaways

- Track What Matters Most. Your monthly income, customer satisfaction, and sales growth are your priority metrics.

- Numbers Drive Smart Decisions Weekly review helps spot opportunities.

- Simple Tools Work Best Start with basic tracking systems.

Business Intelligence Basics for Small Business

Business intelligence doesn’t have to be complicated. Think of it as your business’s dashboard, like the one in your car that shows your speed, fuel level, and engine temperature. It gives you the key information you need to keep things running smoothly.

Most small business owners start out making decisions based on gut feeling. While intuition is valuable, adding solid data to the mix strengthens your decisions. The real power of business intelligence comes from turning complex business information into clear, actionable steps you can take today.

Here are the basic tools you need to get started:

- A simple accounting system like QuickBooks

- Website tracking through Google Analytics

- A basic CRM to track customer information

You don’t need fancy software or complicated systems. These basic tools will give you plenty of insights to work with as you start. Start with simple tools and enjoy the process!

Financial Performance Metrics That Drive Growth

Money matters need to be crystal clear in your business. Monthly Recurring Revenue (MRR) is like your business’s monthly paycheck; it tells you how much reliable income you can count on each month. This is especially important when you’re planning for growth or considering new investments.

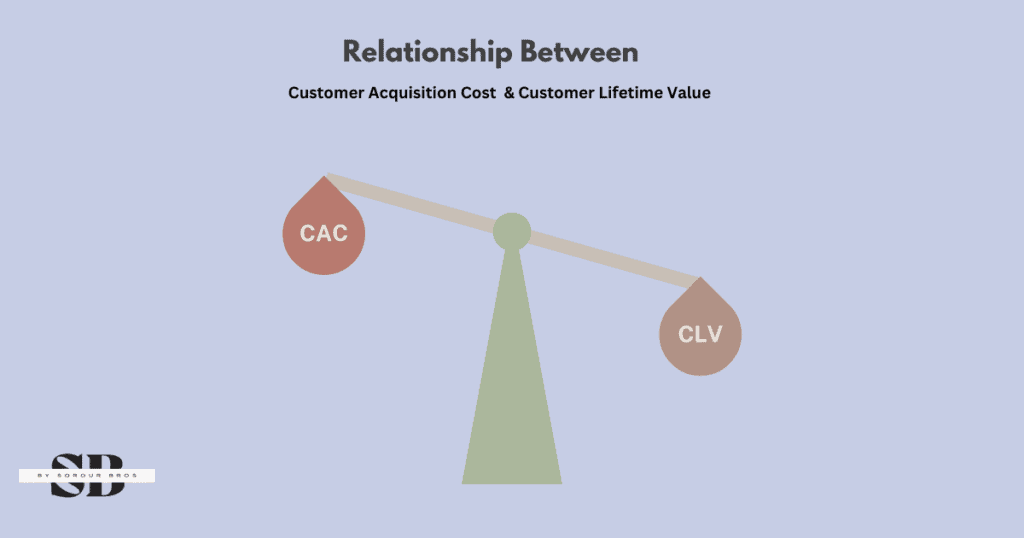

The relationship between how much you spend to get a customer and how much they spend with you over time is crucial. We call these Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV). You can see them well in the image below:

If you want your customers to spend more time with you than it costs to bring them in, Aim for each customer to be worth at least three times what you spent to get them.

Also watch your cash flow like a hawk. You can be making sales and still run into trouble if you don’t have enough cash. Keep enough money in the bank to cover at least three months of expenses. This gives you a safety net when unexpected costs pop up.

Customer-Centric KPIs for Better Decision Making

Your customers are the heart of your business. Understanding what they think and how they behave helps you serve them better. Customer satisfaction scores tell you if you’re meeting their needs. But more importantly, they can warn you about problems before customers start leaving.

When customers do leave, pay attention. A high customer churn rate is like a warning light on your dashboard. It means something needs fixing. Take time to understand why customers leave. Often, they’ll tell you exactly what you need to improve in your business.

A healthy churn rate for most small businesses should stay below 5% monthly. Track why customers leave and use that information to improve your products or services.

Sales and Marketing Performance Metrics

These days, most of your customers probably find you online. That’s why tracking your sales and marketing efforts is so important. Focus on tracking where your best customers come from, not just how many people visit your website.

One customer who’s ready to buy is worth more than a hundred who are just browsing. So, focus on turning usual visitors into loyal customers.

Your marketing budget is an investment. Track what you spend on each marketing channel and what you get back from it. This will help you invest more money in what’s working and stop wasting money on what isn’t.

Operational Efficiency Metrics

Running your business smoothly is just as important as making sales. Watch how efficiently your team works, how quickly you deliver products or services, and how well you use your resources. If you sell products, keep a close eye on your inventory.

Operational efficiency can make or break a small business. Employee productivity ratios help you understand if you’re getting the most out of your workforce investment. But remember, productivity isn’t just about numbers. It’s about achieving more with existing resources.

For retail or product-based businesses, inventory turnover rate is crucial. A low turnover rate means you’re tying up too much cash in inventory, while a very high rate might indicate you’re losing sales due to stock-outs. Aim for the sweet spot that keeps your carrying costs low while ensuring you can meet customer demand.

To summarize, Having too much inventory ties up money, you could use elsewhere while having too little means disappointing customers.

Implementing Your BI Metrics Strategy

Start small with your metrics tracking. Pick just three or four numbers that matter to your business right now. Maybe it’s monthly sales, customer satisfaction, and marketing costs. Whatever you choose, make sure they connect directly to your biggest business goals.

The key to success is regular review. Set aside a little time each week to look at your numbers. What are they telling you? What’s working well? What needs to change? Use this information to decide where to focus your time and money.

Remember, tracking metrics isn’t about gathering data. It’s about making better decisions for your business. When you spot problems in your numbers, don’t panic. Think of them as opportunities to strengthen your business.

Every successful business owner has to start somewhere by tracking their numbers. The important thing is to start today and keep improving as you go.

Your goal isn’t to become a data scientist. It’s to better understand your business and make it more successful. Please keep it simple, focus on what matters most, and let your metrics guide you to smarter business decisions.

Wrapping up

Running a successful business isn’t just about working hard. It’s about understanding what’s really going on in your company. Think of business metrics as your compass. They show you if you’re heading in the right direction or need to change.

Pick one thing to track this week. Maybe it’s your daily sales or how many customers come back to buy again. Please write it down, watch it for a few weeks, and see what it tells you about your business. You’ll be surprised how much clearer your business decisions become when you have actual numbers to guide you.

Remember, every successful business owner started exactly where you are now. They began by tracking just a few important numbers and grew from there. The sooner you start paying attention to your key numbers, the sooner you can make your business stronger and more successful.

Your next step is simple: choose one number to track that matters to your business and start monitoring it today. That’s all it takes to make smarter choices for your business’s future.

Frequently Asked Questions (FAQ)

I’m a Data Enthusiast and Content Writer with a passion for helping people improve their lives through data analysis. I’m a self taught programmer and has a strong interest in artificial intelligence and natural language processing. I’m always learning and looking for new ways to use data to solve problems and improve businesses.